The country’s top fast food chains or quick-service restaurants (QSRs) tapped PayMaya to deploy contactless payments in their stores, drive-thru booths, and online delivery portals. The move is in support to the mandate of new normal, where safety, social distancing, and proper hygiene are among the top priority.

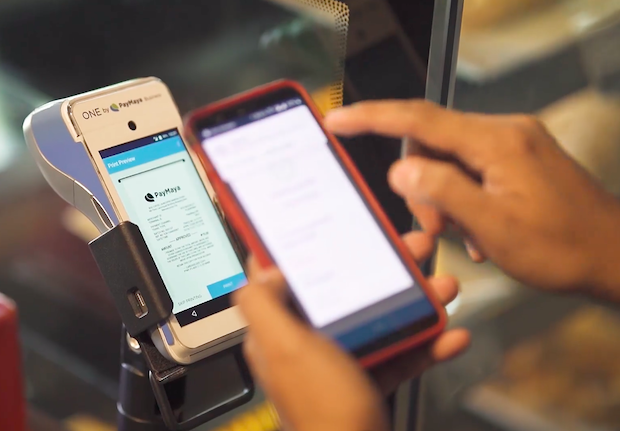

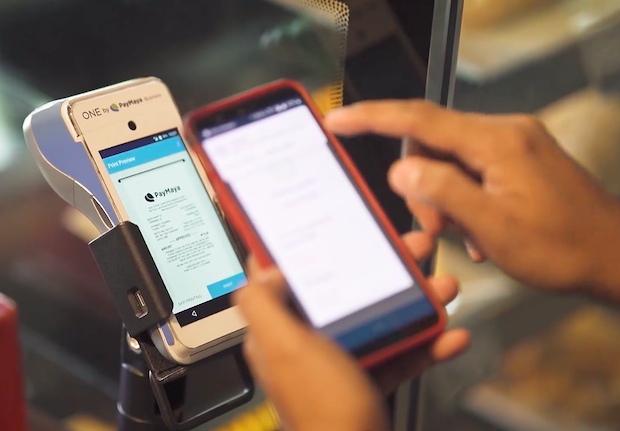

Industry leaders, such as Jollibee Group (Jollibee, Chowking, Greenwich, Mang Inasal, Burger King, and Red Ribbon), McDonald’s, and KFC, have adopted PayMaya’s end-to-end digital payments solutions for enterprise. These restaurants use One by PayMayaPoint of Sale (POS) devices for in-store and drive-thru payment and PayMaya’s payment gateway and digital invoicing solutions for online orders. With the PayMaya solutions, customers can now tap, dip, or swipe their Visa, Mastercard, and JCB credit, debit, and other prepaid cards.

In parallel to enabling cashless payments in their respective store branches, QSRs are strengthening their online channels by enabling digital payment acceptance through the PayMaya Checkout payment gateway.

McDonald’s, for example, has been accepting cashless payments through their McDelivery website, the McDelivery PH App, and soon, via McDonald’s Messenger. They are the first QSR to scale cashless payments back in 2018.

Various brands under Jollibee Group such as Jollibee, Chowking, Mang Inasal, Greenwich, Burger King and Red Ribbon have introduced digital payments through credit/debit cards and via Pay with PayMaya through Facebook Messenger chatbots as a response to the growing trend of “conversational commerce.” Aside from that, Panda Express and Pho24 have implemented PayMaya’s Digital Invoice solution in their ordering system.

KFC, meanwhile, offers an array of digital payment options at its website, which allows ordering via delivery and through store pick-up for advanced ordering.

These efforts are in line with the recent guidelines issued by the Department of Trade and Industry (DTI), wherein alternative payment options are encouraged as part of compliance with health and safety protocols.

Cashless is now emerging as the preferred mode of payment for consumers as Filipinos embrace health and safety protocols under the New Normal. With QSRs adopting PayMaya’s end-to-end digital payments solutions, customers and frontliners alike are experiencing a better way to pay that’s also safer, more convenient, and rewarding – whether the transaction is for dine in, drive-thru, or orders via website or chat.

PayMaya President Shailesh Baidwan

PayMaya’s Digital Invoice solution eases the process of ordering through the fast food chain’s delivery websites or respective hotlines. It allows customers to receive an invoice with a payment link via SMS or email so that they can also pay using their mobile number linked to their PayMaya account or use any Visa, MasterCard, or JCB credit, debit, and prepaid card for the transaction.

With the economy opening up from quarantine measures, the food industry is instituting health and safety protocols, including making cashless acceptance part of the standard options of doing business under the New Normal. This is in compliance with the recent guidelines on the implementation of minimum health protocols issued by the DTI last June 22. Under DTI Memorandum 20-37, restaurants in General Community Quarantine (GCQ) areas may open at thirty percent (30%) operational capacity, provided that venue capacity allows for social distancing protocols and are compliant with the proper protocols prescribed by the DTI. Meanwhile, for areas under Modified General Community Quarantine (MGCQ), the establishments may operate at a maximum of fifty percent (50%) capacity for their dine-in services.

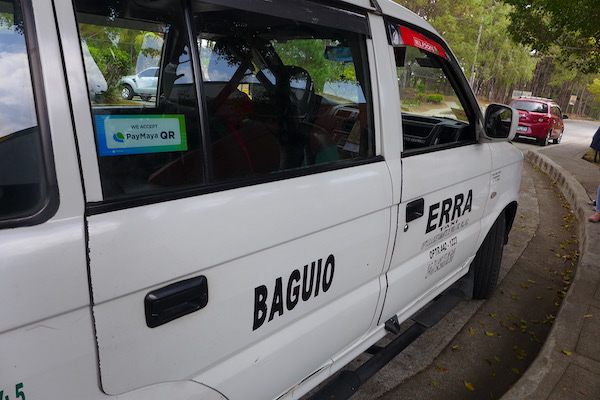

PayMaya is the only end-to-end digital payments ecosystem enabler in the Philippines, with platforms and services that cut across consumers, merchants, and government. Aside from providing payments acceptance for the largest e-Commerce, food, retail and gas merchants in the Philippines, PayMaya enables national and social services agencies, as well as local government units, with digital payments and disbursement services. PayMaya also assists TNVS and taxi operators for their cashless and contactless fare collection system.

Through its app and wallet, PayMaya provides millions of Filipinos with the fastest way to own a financial account with over 40,000 Add Money touchpoints nationwide, more than double the total number of traditional bank branches in the Philippines combined. Its Smart Padala by PayMaya network of over 30,000 partner touchpoints nationwide serves as last mile digital financial hubs in communities, providing the unbanked and underserved with access to services. To know more about PayMaya’s products and services, visit www.PayMaya.com or follow @PayMayaOfficial on Facebook, Twitter, and Instagram.

Nice. This is good news. Sobrang convenient ng PayMaya.

Yes, ang handy ng App.